The AI company that fights financial crime for you

Trusted by leading financial institutions for Fraud & AML to truly prevent fraud loss and finally automate compliance.

GET A DEMOAutomate what you want.

Control what you need.

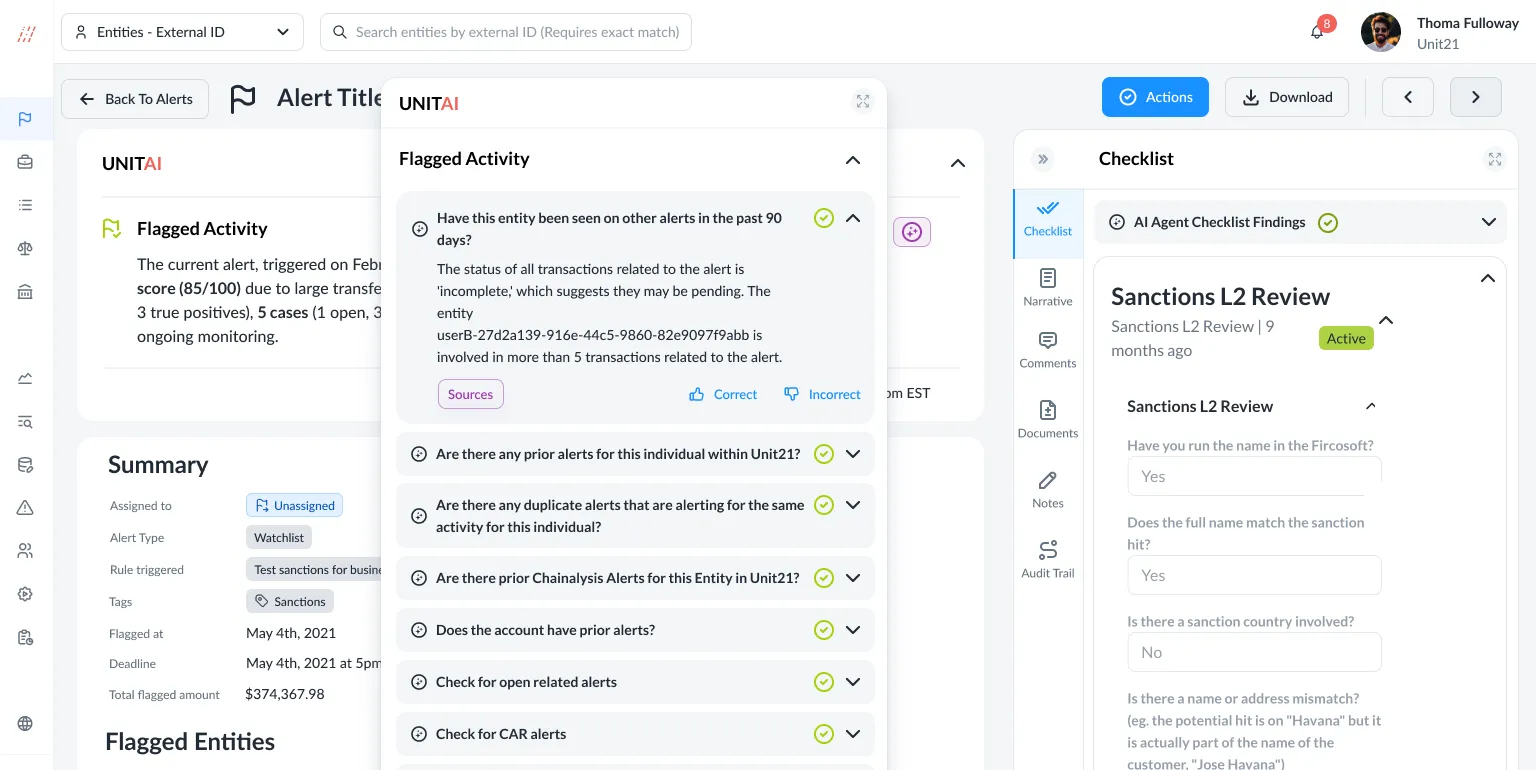

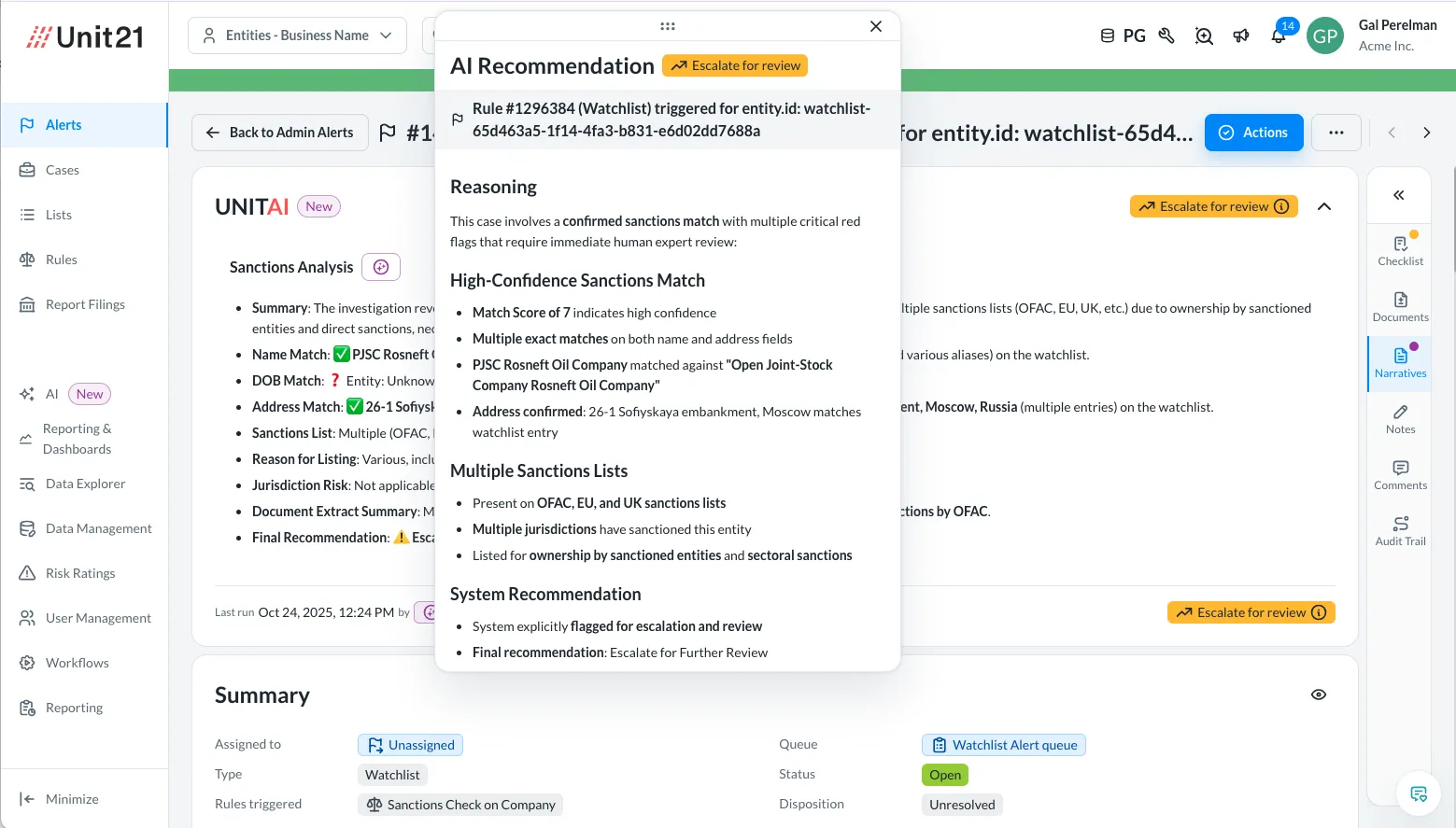

AI that thinks like your best analyst.

With AI Agent, Nexo achieves 57% automation in alert reviews, with projections to reach 80%.

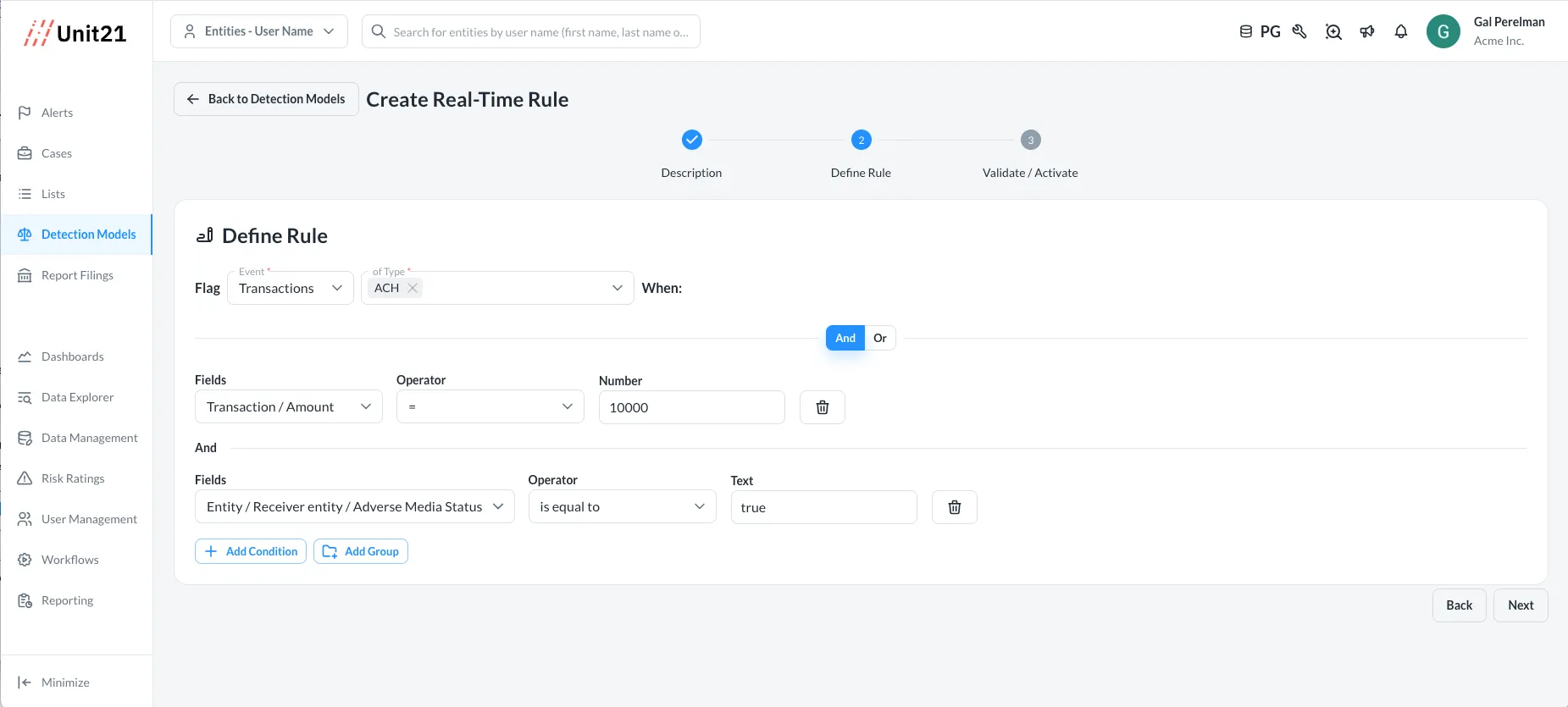

Stop fraud the moment it starts, not after it strikes.

50% reduction in false positives and drastic improvement in alert quality

Surveillance that evolves with the threat.

65% reduction in investigation alert handle time

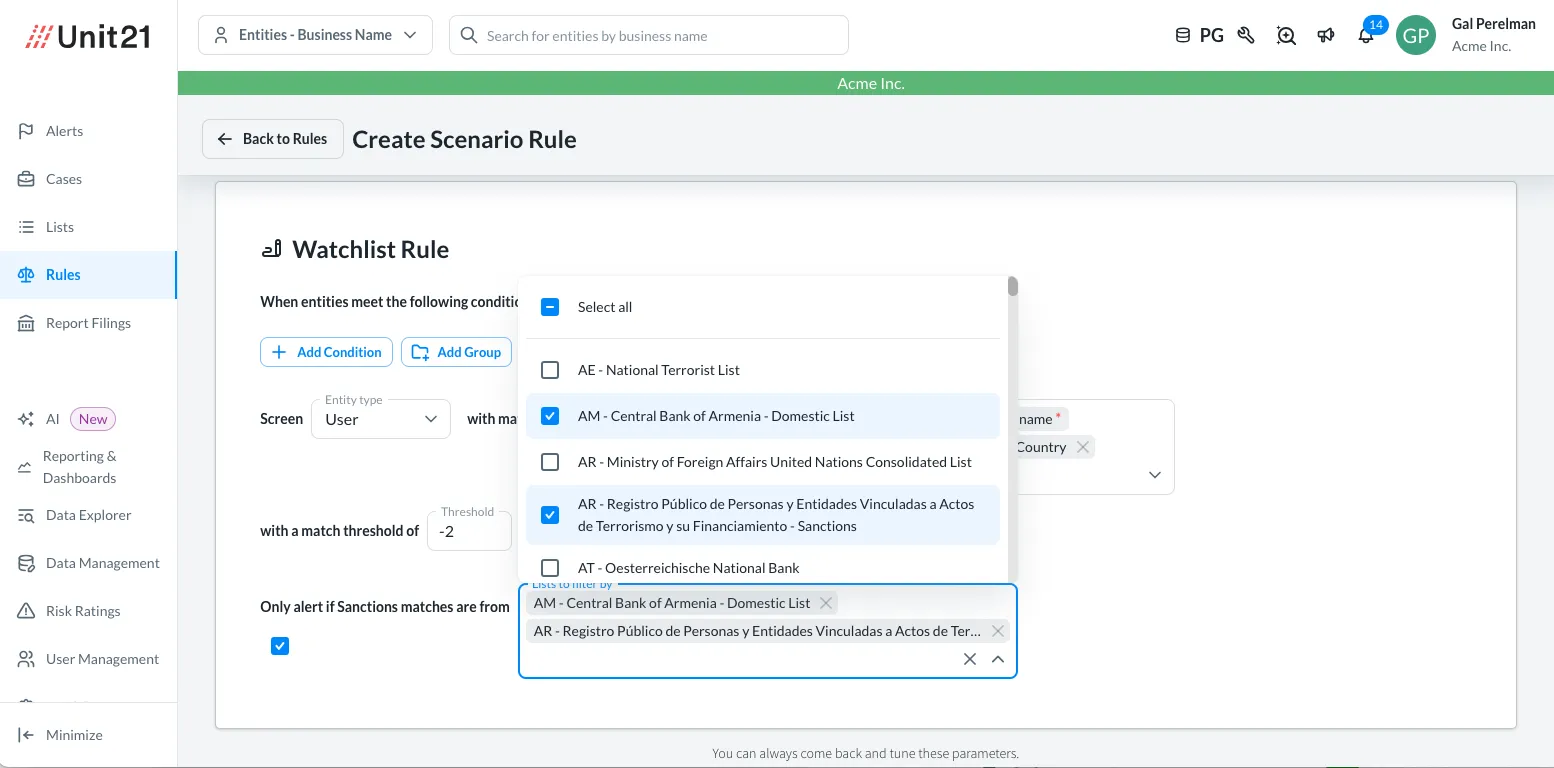

Real-time screening without slowing down payments.

Precision screening that keeps operations moving.

“Having OFAC and sanctions directly integrated in our transaction monitoring allows us to manage all reviews in one place, making oversight faster, stronger, and more efficient.”

Sridevi Anwar, Chief Risk Officer

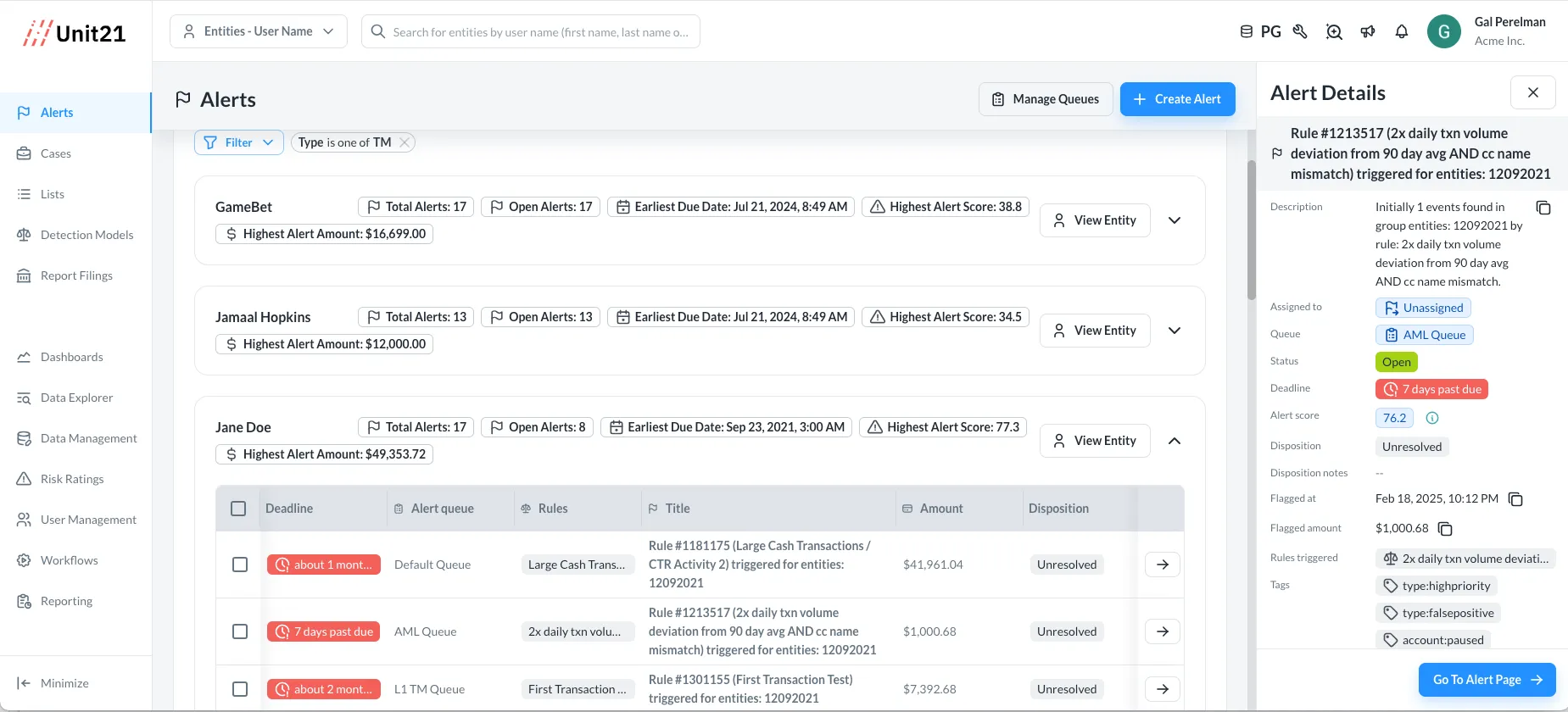

Your central command for financial crime decisions.

“Unit21’s adaptability and robust case management allows us to maintain operation efficiency without compromising compliance requirements”

Kevin Newman, VP of BSA/AML Operations, Greendot

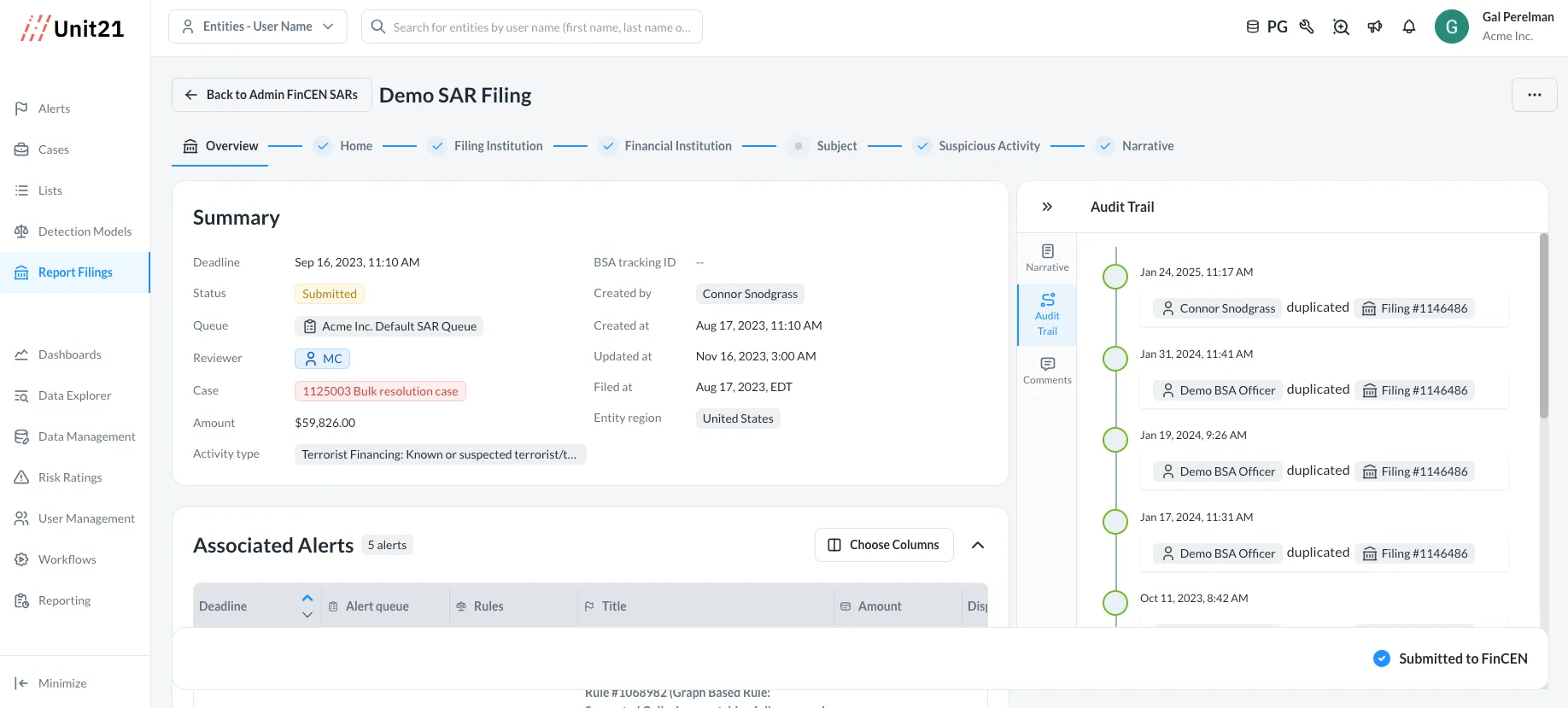

Accurate reports, filed on time, every time.

“With Unit21, an alert becomes a case and a filing in one seamless flow—what used to take days now takes minutes.”

Frank Walton, Global Head of Compliance, Uphold

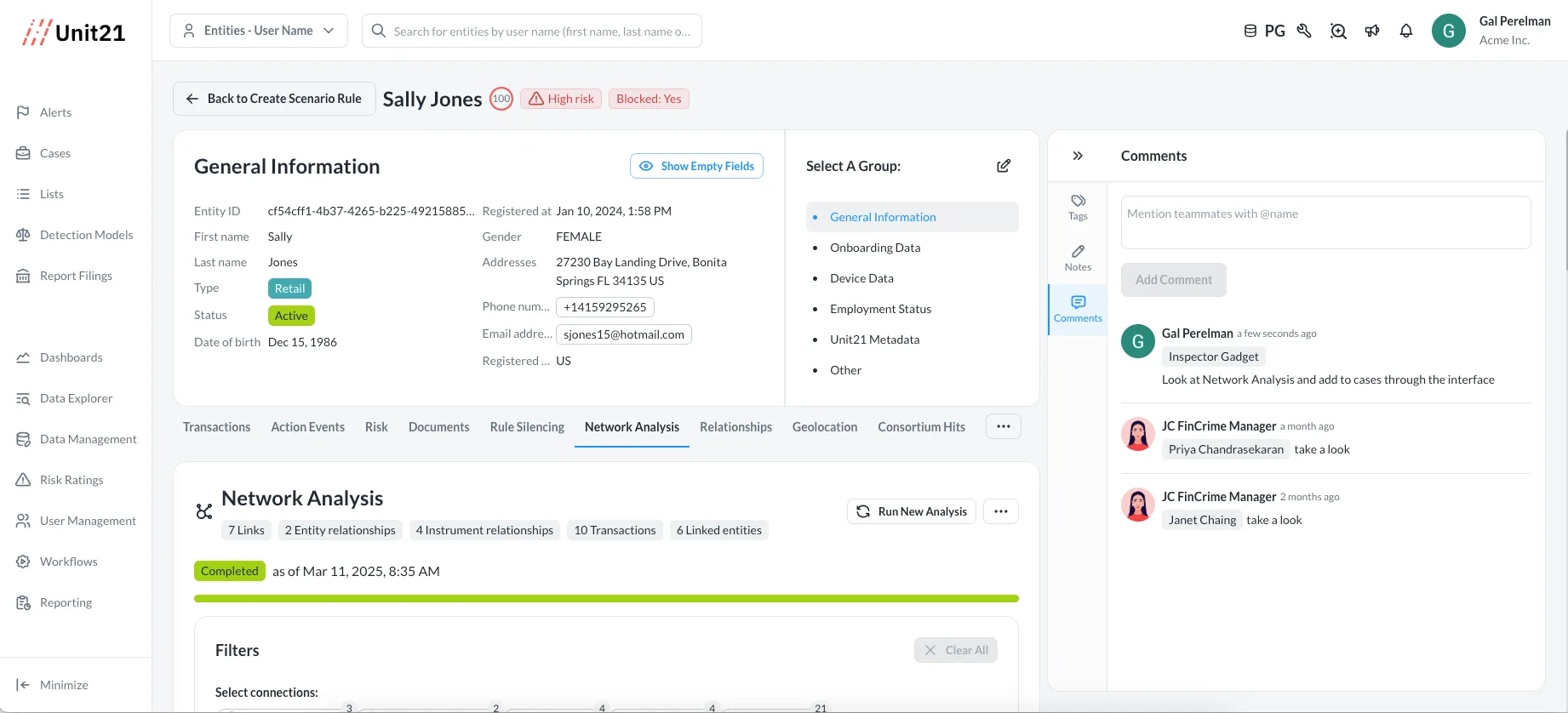

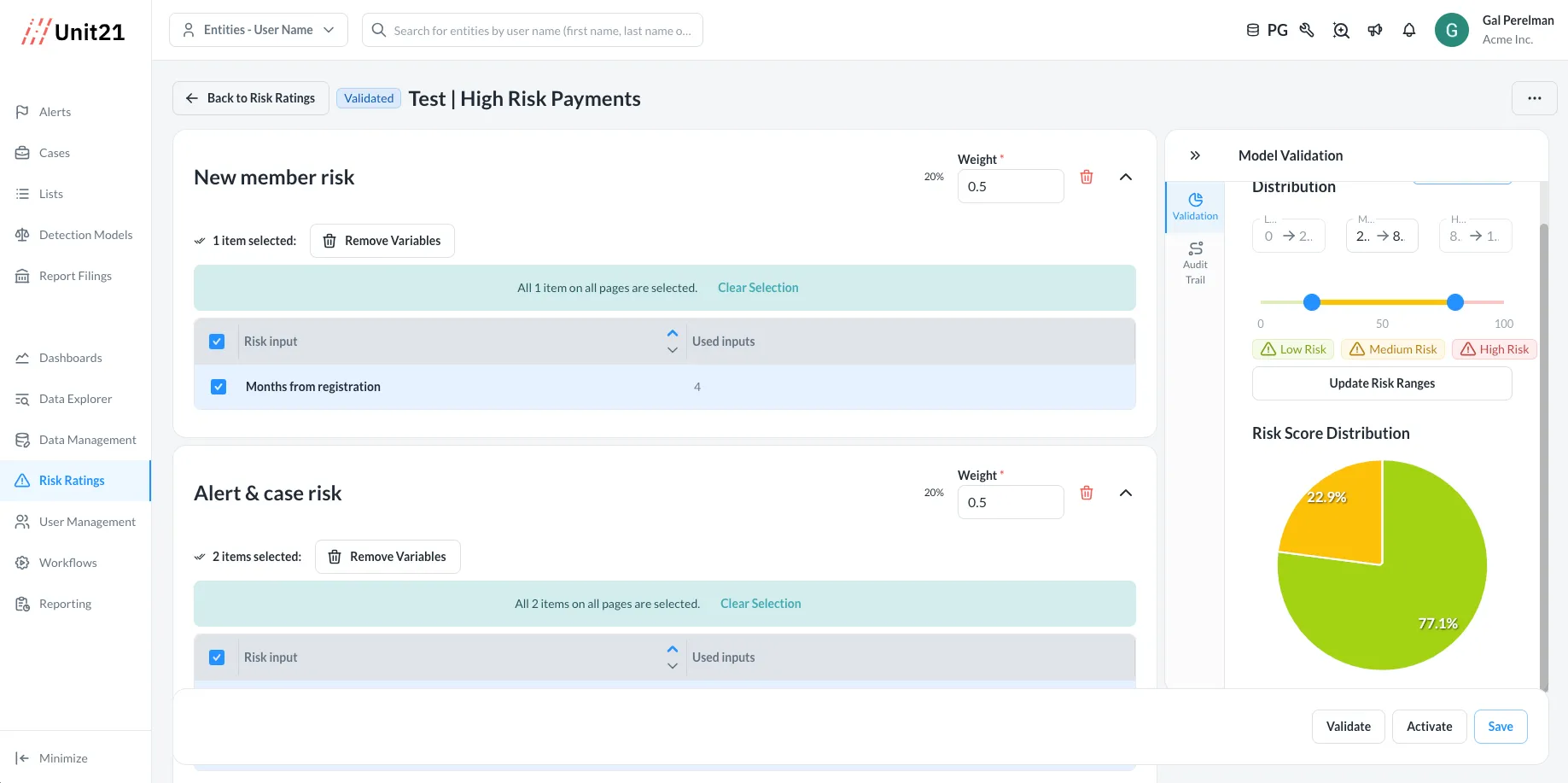

Risk profiles that reflect real customer behavior.

“Having separate risk models for AML and Responsible Gaming is a game-changer. We can measure and manage each type of risk precisely, without compromising compliance or player protection.”

Kitty Boland, Director of AML Operations, Underdog

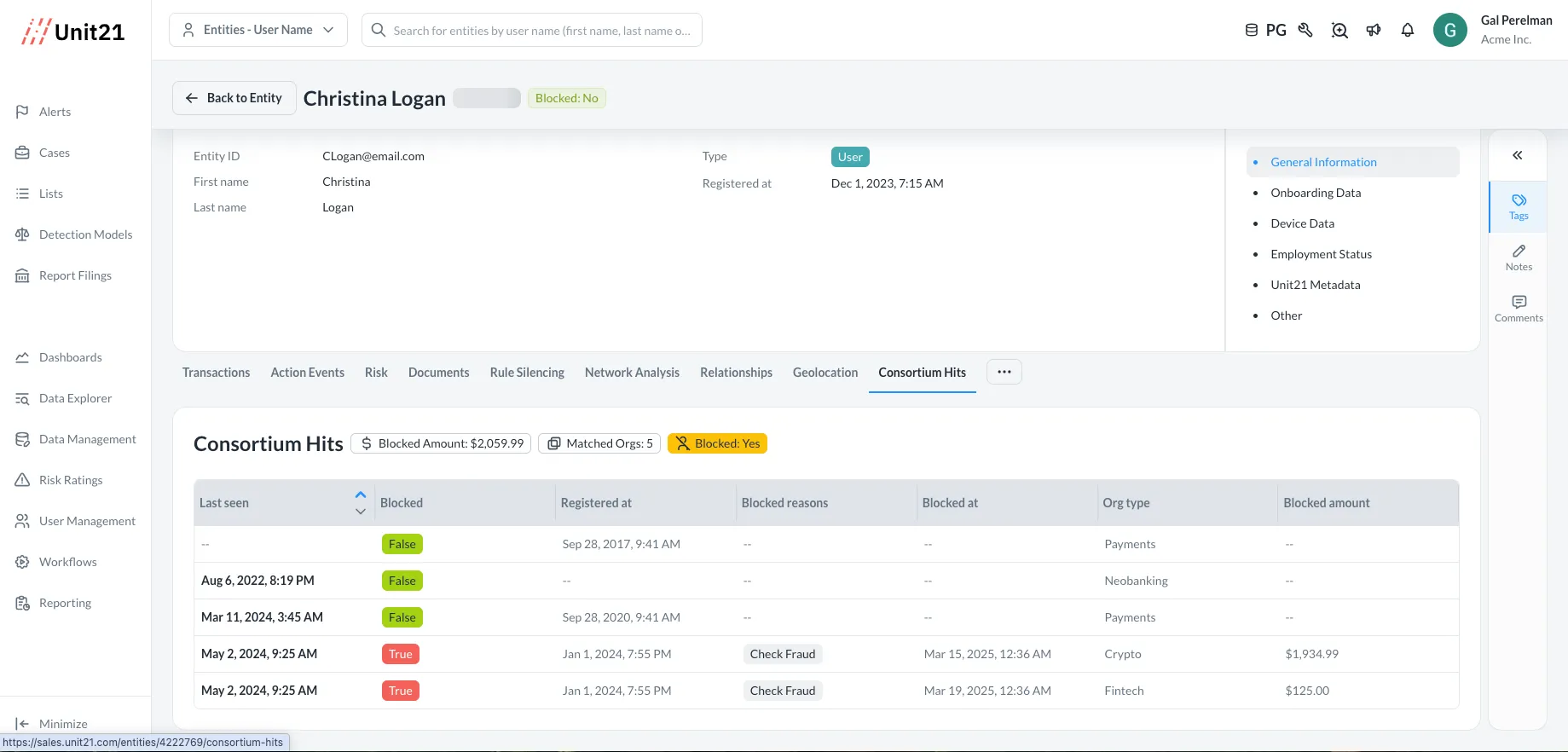

Fraud insights without data sacrifice.

“Having consortium insights built into our investigations lets us spot known bad actors instantly. In one weekend alone, we stopped $70,000 in fraud.”

Jorge Cortes, VP of Enterprise Risk, Kinecta Federal Credit Union

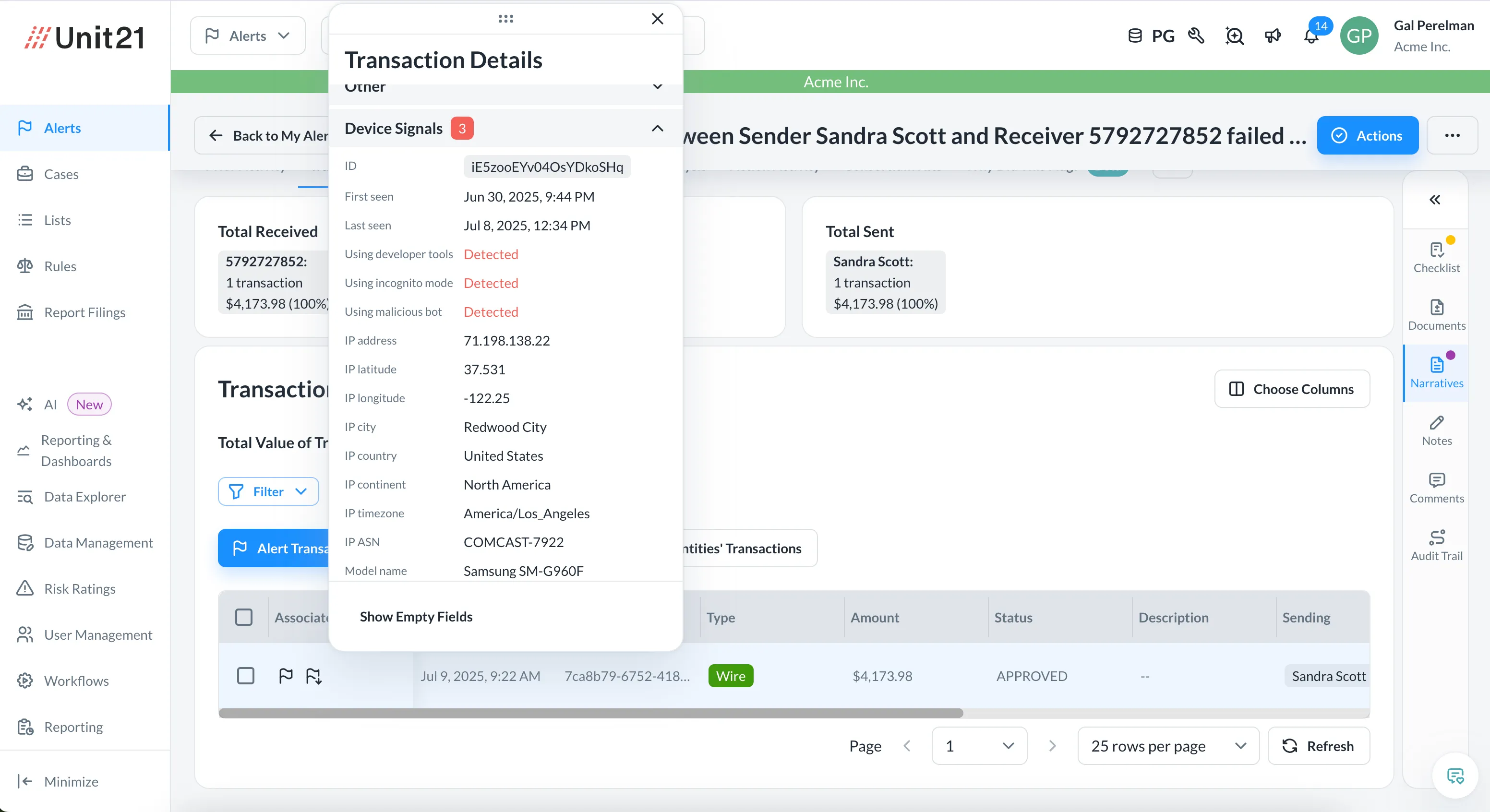

Device signals that expose synthetic fraud.

Focus on stopping real risk.

Not chasing noise.

48,299,536

Supporting the fastest growing & most sophisticated financial institutions

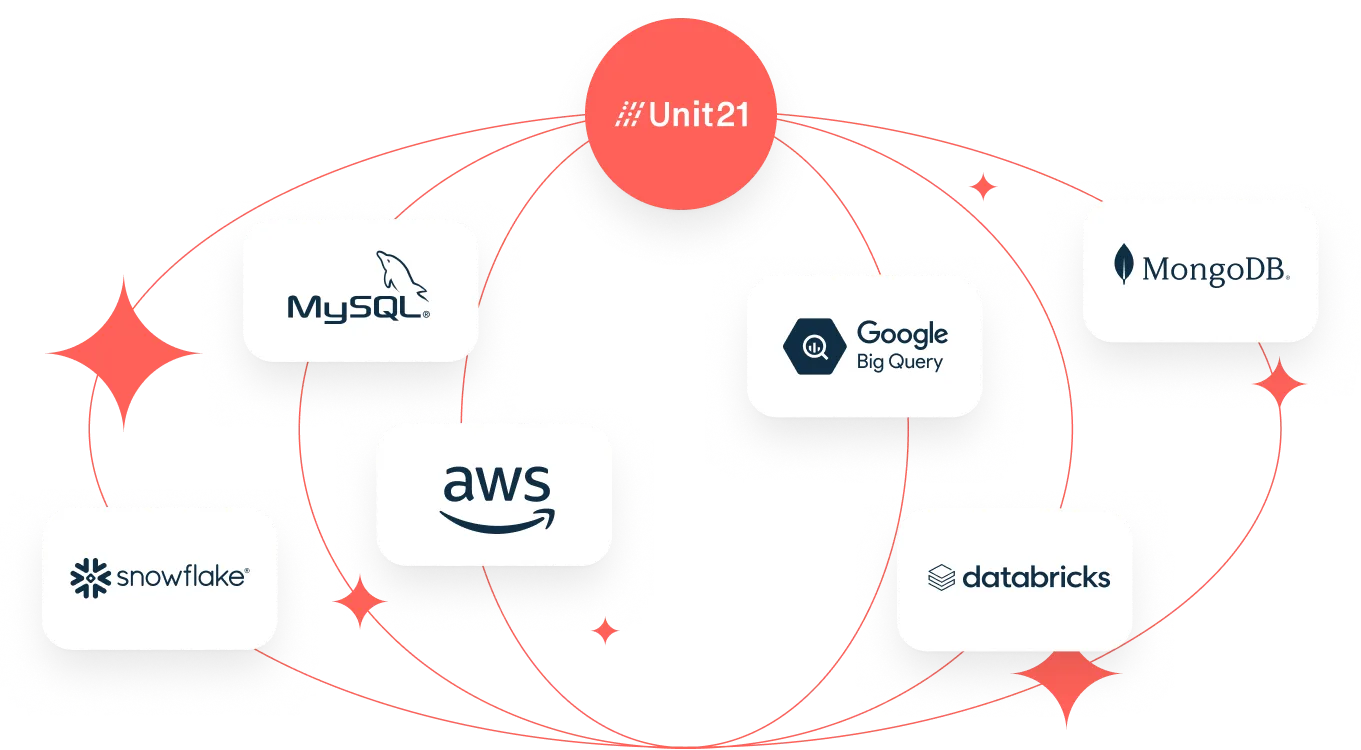

Unit21 can sit on top of any database